The global shift toward renewable energy has positioned photovoltaic (PV) power generation as a cornerstone of the green transition. With declining technology costs, supportive policies, and rising energy demand, PV projects offer compelling investment opportunities. However, like any investment, they require careful analysis of returns and risks to maximize profitability.

Investment Returns: Key Drivers

Falling Costs and Improved Efficiency

Solar panel prices have dropped by over 80% in the past decade, while efficiency continues to rise. This reduces capital expenditures (CAPEX) and boosts long-term returns.

Innovations like bifacial panels and tracking systems further enhance energy yield.

Government Incentives and Policies

Many countries offer subsidies, tax credits (e.g., the U.S. Investment Tax Credit), and feed-in tariffs to encourage solar adoption.

Carbon pricing mechanisms and renewable portfolio standards (RPS) add revenue streams.

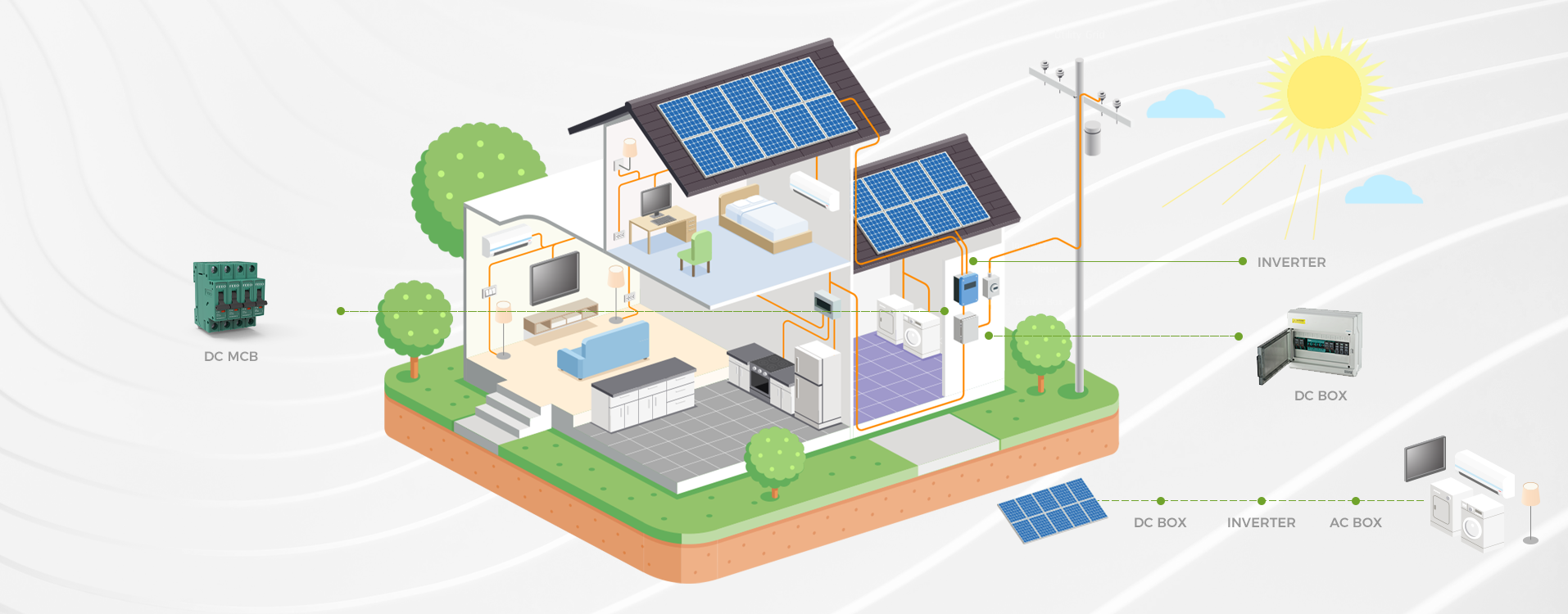

Stable Cash Flow from Power Sales

PV plants generate predictable electricity output, often secured via long-term power purchase agreements (PPAs) with utilities or corporations.

In regions with high retail electricity prices (e.g., Europe), self-consumption or merchant sales can improve returns.

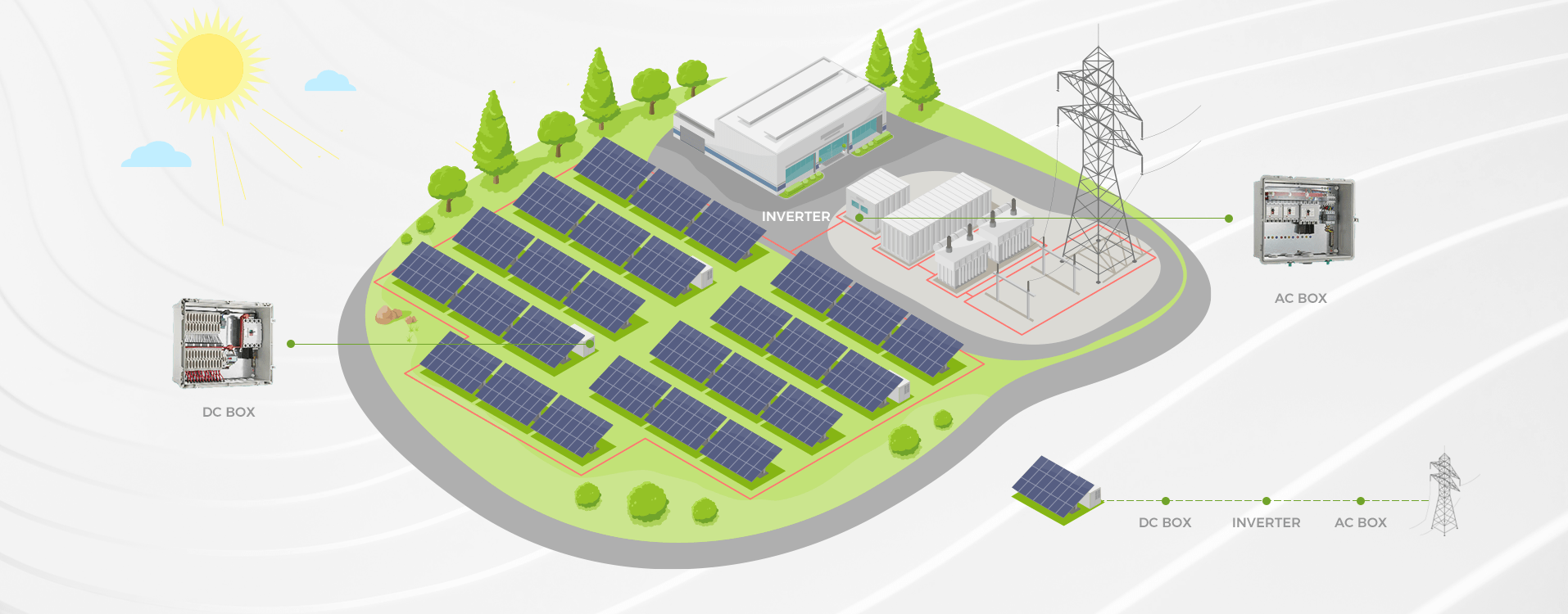

Scalability and Diversification

Investors can choose between utility-scale projects (higher CAPEX but economies of scale) and distributed solar (lower entry barriers).

Portfolio diversification across geographies mitigates weather and regulatory risks.

Risk Control: Challenges and Mitigation

Policy and Regulatory Risks

Sudden subsidy cuts or policy shifts (e.g., retroactive tariff changes in Spain) can hurt profitability.

Solution: Favor markets with stable regulatory frameworks (e.g., Germany, Australia) and hedge risks via contracts.

Technological and Operational Risks

Panel degradation, inverter failures, or poor maintenance reduce output.

Solution: Use tier-1 equipment, invest in O&M (operations & maintenance), and adopt performance insurance.

Market and Price Risks

Merchant solar projects face electricity price volatility (e.g., daytime price cannibalization in high-penetration markets).

Solution: Combine PPAs with battery storage to shift supply to peak-demand hours.

Financing and Interest Rate Risks

Rising interest rates increase project debt costs.

Solution: Secure fixed-rate loans or leverage green bonds for lower-cost capital.

Conclusion: A Balanced Approach

PV investments offer attractive IRRs (Internal Rates of Return), typically ranging from 6% to 12%, depending on location and financing. However, success hinges on:

Thorough due diligence (solar resource assessment, grid access).

Risk diversification (geographic, technological, and contractual).

Adaptability (integrating storage, hybrid systems, or corporate PPAs).

As the world accelerates toward net-zero targets, solar energy remains a resilient and profitable asset class—but only for investors who prioritize both returns and risk management. By leveraging technology, policy tailwinds, and smart financing, stakeholders can truly harness the green energy dividend.